On Monday, August 11th, the Town Council voted to approve an 11.8% increase to the property tax rate, from $0.453 to $0.506441. This amount was chosen to equal the so called de minimis rate, which is the maximum tax increase a city, county, or special district in Texas can levy without triggering an automatic election to approve the tax rate.

Combined with the 8.84% increase in the average taxable homestead value, this will increase the average homestead’s property taxes by $451.25, or 21.69%, and raise an additional $1,333,997 for the Town’s budget:

The de minimis tax rate system is a product of Senate Bill 2 (“S.B.2”), also known as the Texas Property Tax Reform and Transparency Act of 2019. That act lowered the rate a Town can increase their taxes without an automatic election for voter approval, and made several changes to the property appraisal and property tax adoption processes. Under this law, the voter approval rate is whatever rate would 1) pay for debt service obligations of the town, and 2) increases the amount of tax raised to pay for M&O (Maintenance & Operations) by 3.5% (versus 8% under pre-S.B.2 law), but for Sunnyvale this year the voter approval rate would be $0.504715. The de minimis rate is a provision that allows cities with less than 30,000 residents to raise up to $500,000 in new revenue for M&O on top of whatever they need to raise for paying debt (like our new $36 million bond issue) without triggering an automatic election. There is some complicated steps in determining what the “no new revenue” tax rate is (so you can add $500,000 in marginal new revenue to that), but for Sunnyvale the now new revenue rate is $0.449529. The de minimis rate for this year is $0.506441. You can see all the rates in this table:

I am not a lawyer, but as I understand S.B.2, if residents still oppose the tax increase, they may still submit a petition for an election to approve or disapprove the tax increase.1, 2 That’s because this year our Town Council’s tax proposal matches but doesn’t exceed the de minimis rate (above that would have triggered an automatic election), but it is still above the voter approval rate.

However, there still probably isn’t much point in petitioning: even if residents were to vote down the tax increase, it would just reduce the tax rate to no more than the voter approval rate (i.e., $.504715 instead of $.506411, or just $9.55 in property taxes per year for the average homeowner in Sunnyvale).

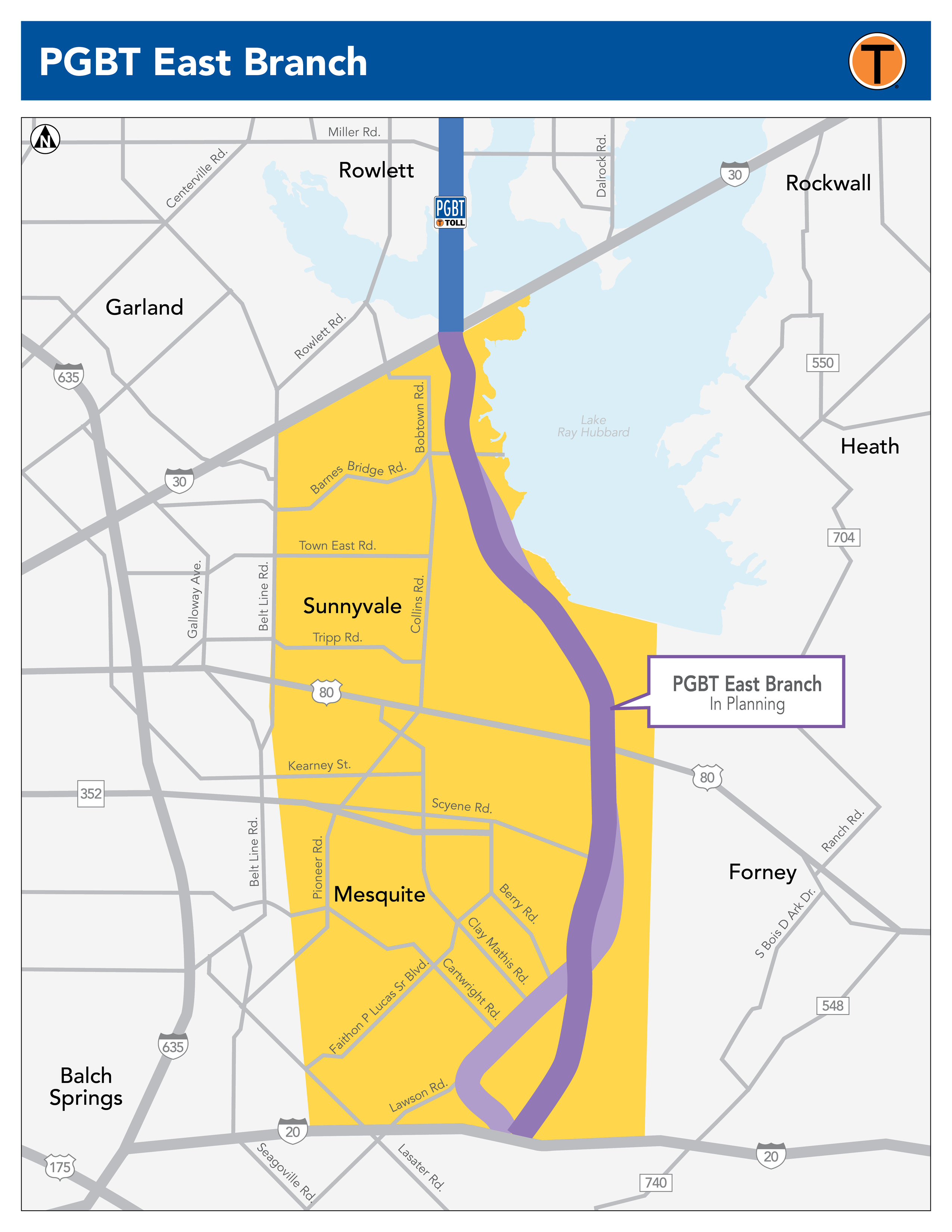

So if the Town is raising taxes, where are the funds going? According to slide 14 of the Budget Presentation, the funds will go to road improvements, replacing concrete panels across town. During the Town Council meeting, there are about $2 million of concrete panels in our roads needing replacement currently. As Town staff also presented in the August 11th meeting, our town places about 6th from the bottom in every city in Dallas County in terms of property taxes. Looking at cities directly around us, we are about 5th lowest (Rockwall is lowest, then Fate, Heath, Forney, Sunnyvale).

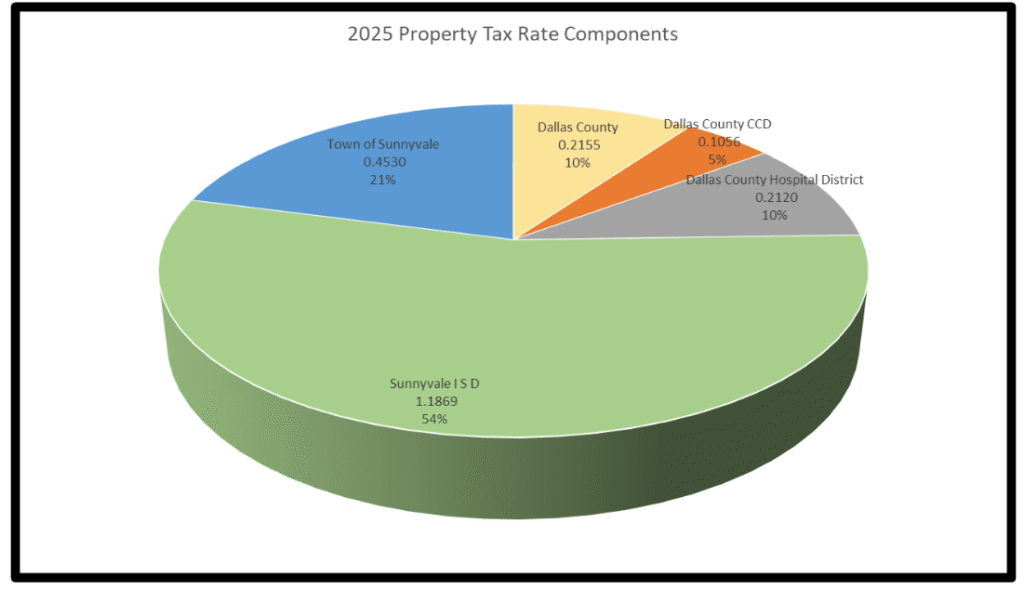

Lastly, looking at our overall property tax burden, the majority of our property taxes actually come from our excellent schools, and this tax increase won’t change that: